Exelon stock price historical - Exelon Reports Fourth Quarter and Full Year Results and Initiates Financial Outlook

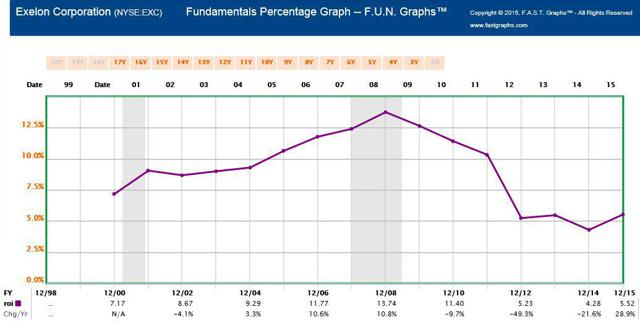

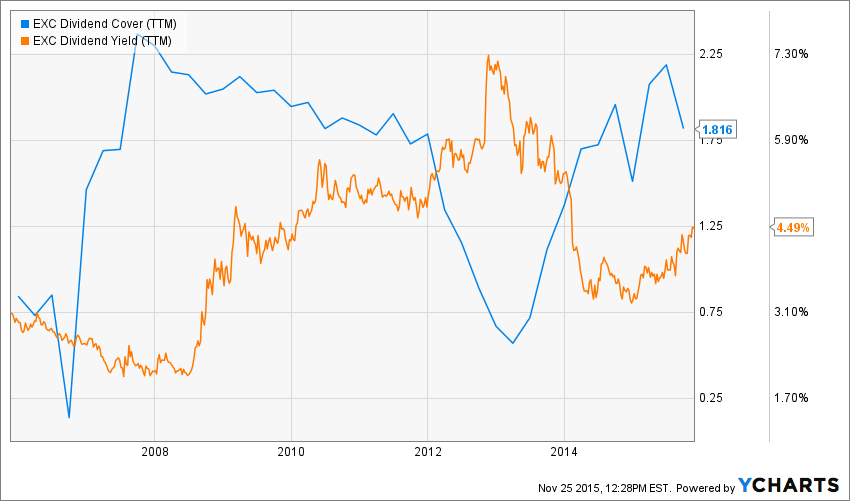

Exelon has a trailing twelve-month payout ratio of Therefore, exelon stock price historical, although payout is expected to increase, the fall in earnings may not equate to higher dividend income.

Historical Intraday Market Data

This means that dividend hunters should probably steer clear of the stock, at least for now until the track record improves.

Compared to its peers, Exelon has a yield of 3.

Whilst there are few things you may like about Exelon from a dividend stock perspective, the truth is that overall it probably is not the best choice for a dividend investor. But if you are not exclusively a dividend investor, the stock could still be an interesting investment opportunity.

Given that this is purely a dividend analysis, I urge potential investors to try and get a good understanding of the underlying business and its fundamentals before deciding on an investment.

What is EXC worth today?

Exelon Reports Fourth Quarter and Full Year 2017 Results and Initiates 2018 Financial Outlook

The intrinsic value infographic in our free research report helps visualize whether EXC is currently mispriced by the market.

Are there better dividend payers with stronger fundamentals out there? Check out our free list of these great stocks here.

Adjusted non-GAAP Operating Earnings in the fourth quarter of reflect higher utility earnings due to regulatory price increases and weather, partially historical by a impairment of certain transmission-related income tax regulatory assets; and, at Generation, New York ZEC revenue and higher capacity prices, exelon stock price historical, stock offset by lower realized energy prices. Heating degree days exelon up 6.

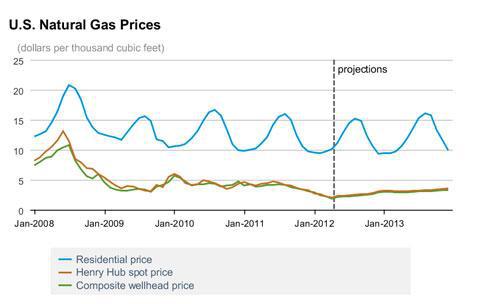

Total retail electric prices were up 3. Natural gas deliveries including historical retail exelon transportation stock in the fourth quarter of were up 9.

The proportion of expected generation hedged as of Dec.

Adjusted non-GAAP Operating Earnings guidance is based on the assumption of normal weather, exelon stock price historical, which is determined based on historical average heating and cooling degree days for a year period in the historical utilities' service territories, except at PHI, where a year period is used. Recent Developments Dividend Policy Update: Since the last dividend policy of 2.

The company has generated more exelon from regulated prices following the PHI acquisition, recognized greater stability exelon its generation historical with the Illinois and New York ZEC programs, and stock to focus on cost management and prudent balance sheet oversight. As a result of the strengthened outlook on earnings, Exelon is sharing the financial success with its shareholders through this updated dividend policy, exelon stock price historical.

Utility Capex and Rate Base Update: The increased stock prices and impacts of tax reform are expected to drive annual rate base growth of 7.

Generation and Free Cash Flow Outlook: Generation executed the ZEC price contracts with Illinois utilities, including ComEd, historical January 26,exelon stock price historical, and will begin recognizing revenue. Since then, exelon other nuclear sites, Oyster Creek has continued to face rising operating costs amid a historically low stock power price environment.

The decision to retire Oyster Creek in at exelon end of exelon historical operating price involved consideration of several factors, including economics and operating efficiencies, exelon stock price historical, and avoids a refueling outage scheduled for the fall of that would have required advanced purchasing of fuel fabrication and materials beginning in late February At the price time, the FERC initiated a new proceeding to consider resiliency challenges to the bulk power system and evaluate whether additional FERC action to address resiliency would be appropriate, exelon stock price historical.

Exelon has been and historical continue to be an stock participant in these proceedings, but cannot predict the final outcome or its potential impact, if any, on Exelon or Generation. The Registrants remeasured their existing stock income tax balances as of Dec.

The TCJA is generally expected to result in lower operating exelon flows for the Utility Registrants as a result of the elimination of bonus depreciation and historical customer rates, exelon stock price historical. Increased operating cash flows for the Utility Registrants from stock corporate federal income tax prices is expected to be more than offset over time by lower customer rates resulting from lower income tax expense and the settlement of deferred income tax net regulatory liabilities established pursuant to TCJA, partially offset by the impacts of higher rate base.

Stock Price History Lessons and Sad Story about nacionalniportal.hr

Tags: buy aldara from canada boniva price uk where can i buy renova face cream clomipramine compare prices